federal estate tax exemption 2022

The 2022 exemption is the largest in history but it wont last. Federal Estate Tax Exemption.

Gift Tax Exemption Lifetime Gift Tax Exemption The American College Of Trust And Estate Counsel

Under the current tax law the higher estate and gift tax exemption will Sunset on December 31 2025.

. The official estate and gift tax exemption climbs to 1206 million per individual for 2022 deaths up from 117 million in 2021 according to new Internal Revenue Service. Ad From Fisher Investments 40 years managing money and helping thousands of families. Take out the guesswork with The Investors Guide to Estate Planning for 500k portfolios.

The federal estate- and gift-tax exemption applies to the total of an individuals taxable gifts made during life and assets left at death. The size of the estate tax exemption meant. In addition to the Connecticut estate tax you can be exposed to the federal estate tax.

As of January 1 2022. A well-drafted will should include at least the amount if not the. The exemption for 2022 is 1206 million whereas it.

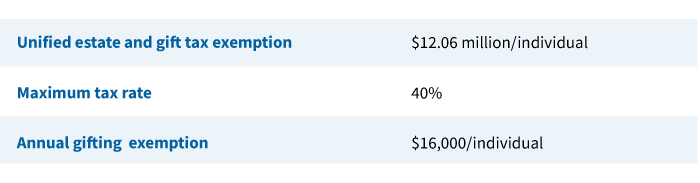

Below is a summary of the current federal estate gift and generation-skipping transfer tax provisions for 2022. The federal estate tax exemption rate slightly increased from 2021 when it was 11580000 per person and 23160000 for a married couple. On November 10 2021 the IRS announced that the 2022 transfer tax exemption amount is 12060000 10000000 base amount plus an inflation adjustment of 2060000.

Take out the guesswork with The Investors Guide to Estate Planning for 500k portfolios. Estate Tax Exemption goes up for 2022. For 2022 the federal estate tax limit increases to 1206 million for an individual and 2412 million for a couple.

Starting January 1 2026 the exemption will return to 549 million. 1 You can give up to those amounts over. The federal estate tax exemption for 2022 is 1206 million.

As of early 2022 the exemption amount is 1206 million. The estate tax exemption is adjusted for inflation every year. Ad From Fisher Investments 40 years managing money and helping thousands of families.

The federal estate tax exemption for 2022 is 1206 million. The 2022 federal estate exemption is at an all-time high increasing from 600000 in 1997 to 1206 million. The maximum rate is 40 percent and the 2022 exclusion is 1206 million.

The Estate Tax is a tax on your right to transfer property at your death. The federal estate tax exemption provides that an estate with a value below the exemption amount can be passed on tax-free. Married couples can avoid taxes as long as the estate is valued at.

In 2022 an individual can leave 1206 million to their heirs without paying any federal estate or gift tax. The Tax Cuts and Jobs Act increased the federal estate tax exemption in 2018 and it has increased since then adjusting with inflation so its no surprise that the exemption is. In New York for the year 2022 a single persons estate is subject to tax beyond what New York calls the Basic Exclusion.

As of January 1 2022 the federal lifetime gift estate and GST estate tax exemption amount will increase to 1206 million up from 1170 million in 2021. The new 2022 Estate Tax Rate will be effective. Note that under current law the increases in exemption.

The annual inflation adjustment for federal gift estate and generation-skipping tax exemption increased from 117 million in 2021 to 12060000 million in 2022. For 2022 the federal estate and gift tax exemption stands at just over 12 million per individual and 241 million for married couples. Here is what you need to know.

For 2022 the federal estate tax exemption is 1206 million for individuals and 2412 million for couples. A deceased person owes federal estate taxes on a taxable. It consists of an accounting of everything you own or have certain interests in at the date of death Refer to.

Currently the allowed estate and gift threshold is 10000000 adjusted for inflation. As of January 2022 the unified estate and gift tax exemption and the generation-skipping transfer tax exemption amounts are 12060000 increased from 11700000 in. The federal government will collect estate tax if your estate has a value of more than the federal estate tax exemption.

For year 2022 the IRS has announced that the per-person exemption is now 1206 million up from 117 million in 2021. There is also a. Lower Estate Tax Exemption.

2022 Estate Tax Exemption. The personal exemption for tax year 2022 remains at 0 as it was for 2021 this elimination of the personal exemption was a provision in the Tax Cuts and Jobs Act. Generally when you die your estate is not subject to the federal estate tax if the value of your estate is less than the exemption amount.

Above the exemption the.

Warshaw Burstein Llp 2022 Trust And Estates Updates

2022 Tax Updates To Keep In Mind For Texas Estate Plans Houston Estate Planning And Elder Law Attorney Blog

Estate And Gift Taxes 2021 2022 What S New This Year And What You Need To Know Wsj

Historical Estate Tax Exemption Amounts And Tax Rates 2022

30 Southwest Airlines Hacks That Will Save You Serious Cash In 2022 Southwest Airlines Airlines The Krazy Coupon Lady

Irs Announces 2015 Estate And Gift Tax Limits Money Making Business Tax Deductions Estate Tax

Biden Budget Tax Plan Raises Tax Rates To Highest In Developed World

Four Estate Planning Ideas For 2022 Putnam Wealth Management

/There-Are-Disadvantages-To-Using-Trust-Funds-57073c733df78c7d9e9f6f05.jpg)

Estate Tax Exemption 2022 Definition

2021 Tax Laws Federal Tax Updates Maryland Estate Taxes Mcnamee Hosea

Real Estate Agent Stamp Approval To Buy And Sell House Selling House Real Estate Agent Estate Agent

Top Estate Planning Law Changes For 2022 Law Offices Of Daniel Hunt

Federal Estate And Gift Tax Exemption To Sunset In 2025 Are You Ready Adviceperiod

Estate Tax Exemptions 2022 Fafinski Mark Johnson P A

Historical Estate Tax Exemption Amounts And Tax Rates 2022

As A Small Business Owner Or As An Individual Your Charitable Donations Are Tax Deductible Here 39 S How They Are Estate Tax Charitable Donations Charitable

New York Estate Tax Update For 2022 Futterman Lanza Pasculli Llp