pa educational improvement tax credit application

A separate election must be submitted for each year an EITCOSTC is awarded. Businesses can apply for a tax credit of up to.

Earned Income Tax Credit Eitc Definition Taxedu

That is when credits are carried forward the amount of credits carried forward will not reduce the amount of credits which an applicant can apply for or use in a subsequent year.

. Forms Publications Forms for Business Corporation Tax For questions regarding utilization of the Educational Improvement Tax Credit contact the PA. When do you apply. The Educational Improvement Tax Credit is a program of the Commonwealth of Pennsylvania administered through the Department of Community and Economic Development that allows eligible businesses to apply tax credits against their tax liability for the year in which the contributions were made.

For two year applicants the deadline is May 15. Guidelines for this win-win opportunity access httpsdcedpagovdownloadeducational-improvement-tax-credit-program-eitc-guidelineswpdmdl84406. EITC OSTC Frequently Asked Questions Learn more about the top asked questions for the Educational Improvement and Opportunity Scholarship Tax Credit.

Application information from the Pennsylvania Department of Community and Economic Development. The deadline to submit your application for the EITC program is July 1 when making a one year commitment. Tax credits may be applied against the tax liability of a business for the tax year in which the contribution was made.

Pennsylvania gives tax credits to eligible businesses contributing to a Scholarship Organization an Educational Improvement Organization andor a Pre-Kindergarten Scholarship Organization. 90 tax credit for donors with 2 year commitment. The Educational Improvement Tax Credit EITC and Opportunity Scholarship Tax Credit OSTC programs provide tax credits to eligible individuals contributing to the Scholastic Opportunity Scholarship Fund via one of the Special Purpose Entities formed for the benefit of the Scholarship Organization at the Diocese of Pittsburgh.

About 73 percent of Pennsylvania students. EDUCATIONAL IMPROVEMENT PO BOX 280604. This program awards tax credits to businesses that make contributions to qualified Scholarship and Educational Improvement Organizations.

The Business Application Guide explains the process of applying. Pennsylvanias Educational Improvement Tax Credit program helps tens of thousands of students access schools that are the right fit for them but policymakers could do more to expand educational opportunity. The EITC Irrevocable Election to Pass Through form REV-1123 is available at wwwrevenuepagov Reference.

Guidelines are available at the DCED website. The Pennsylvania Educational Improvement Tax Credit EITC can be very beneficial to companies conducting business in Pennsylvania by reducing tax liability. Click on the Single Application link under Programs and Funding in the main menu.

The Educational Improvement Tax Credit EITC is available to eligible businesses that contribute to scholarship organizations including pre-kindergarten and educational improvement organizations in order to promote expanded educational opportunities for students in Pennsylvania. Download File Educational Improvement Tax Credit Program EITC Guidelines Educational Improvement Tax Credit Program EITC Guidelines May 3 2018. Instead of creating their own SPE individuals may join CSFPs fully-managed SPE and we handle everything.

Pennsylvania businesses can apply for EITC credits through the PA Department of Community Economic Developments electronic single application system which can be accessed by clicking here. The Program Guidelines provide more information. Applicants are required to submit applications electronically.

Pennsylvanias Educational Improvement Tax CREDIT EITC Apply for PA Tax credits available to eligible businesses contributing to scholarship organizations such as CEO America the Childrens Educational Opportunity Fund. But that doesnt mean that the proposal from House Speaker Mike Turzai R-Allegheny is going to disappear anytime soon. Access the EITC Business Electronic Application.

Additionally the REV-1123 Educational Improvement Opportunity Scholarship Tax Credit Election Form will be revised to reflect the carryover provisions. For example an organization with a 630 year-end will provide one Part I Fiscal Report for FY end 63018 and a second report for. Use of Tax Credits - As administeredby the PA Departmentof Revenue.

Individuals can form a Special Purpose Entity SPE to get tax credit applied to personal PA taxes and help low-income children receive quality K-8th grade education. Eligibility for the scholarships is limited to students from low- and middle-income families. Tax credit applications will be processed on a first-come first-served basis by day submitted.

Part I as part of their FY 1920 renewal application. Ad Download or Email PA REV-1123 More Fillable Forms Register and Subscribe Now. Irrevocable election to pass Educational Improvement Tax Credit EITCOpportunity Scholarship Tax Credit OSTC through to shareholders members or partners.

Tyler Arboretum is an eligible Educational Improvement Organization and uses awarded EITC funds for our. Tom Wolf said Wednesday that he will veto a proposed expansion of Pennsylvanias Educational Improvement Tax Credit which directs millions of potential tax dollars each year to private schools and educational programs. Key features of the EITC.

The Tioga County Foundation is pleased to offer its services as an approved Educational Improvement Organization for the Pennsylvania Educational Improvement Tax Credit EITC Program. Applications will be approved until the amount of available tax credits is exhausted. After submitting your application wait for approval from the state.

Tax credit cannot be switched to the more popular Education Improvement EI tax credit in. Go to the PA Department of Community Economic Development DCED Website. The application cycle for new business applicants opens on July 1 of each year.

New Mexico S Working Families Tax Credit And The Federal Earned Income Tax Credit New Mexico Voices For Children

Pay Off Your Debt With A Personal Loan In 2022 Personal Loans Saving Money Chart Money Chart

Six Tips To Help Your Child Learn To Read Www Papromiseforchildren Com Learn To Read Kids Learning Learning

News Misericordia University Landmark Community Bank Supports Children S Programming At Speech L Speech And Language Programming For Kids Language Disorders

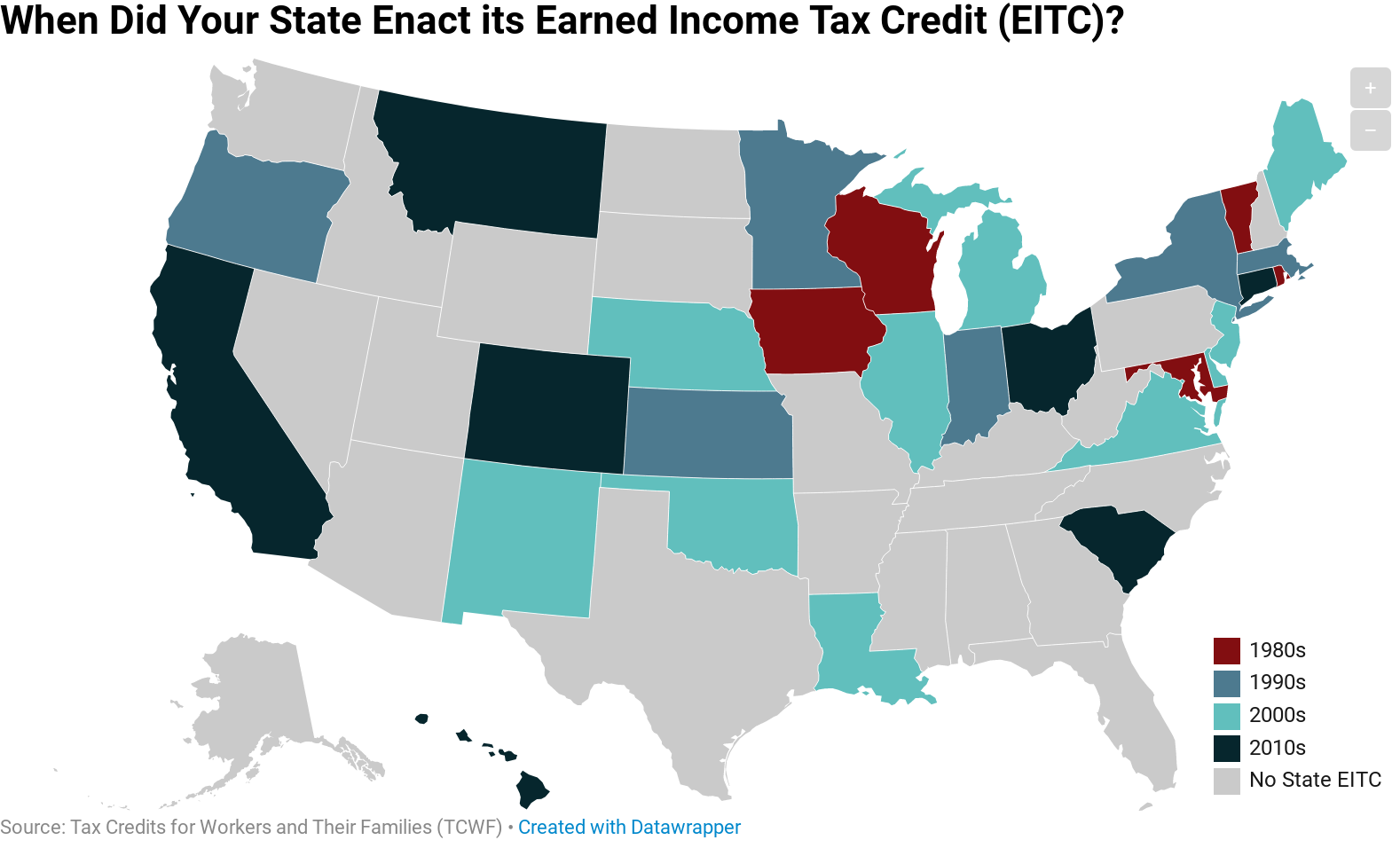

When Did Your State Enact Its Eitc Itep

Five Ways To Save For A Home Loan Visual Ly Home Loans Home Improvement Loans Loan

5 Promises For School Success Pa Promise For Children School Success School Success

Earned Income Tax Credit Eitc Definition Taxedu

What Are Marriage Penalties And Bonuses Tax Policy Center

New Birth Of Freedom Council Bsa Website For The New Birth Of Freedom Council Bsa

Business Invoice Financing Purchase Order Finance Lease Financing Merchant Finance Small Business Lending Small Business Banking

Navigating Financial Success For School And Beyond Loans For Bad Credit No Credit Check Loans Loan Money

Earned Income Tax Credit Eitc Definition Taxedu

More Than 80 Percent Of 4th And 8th Grade Students In The School District Of Philadelphia Didn T Reach Proficiency In M Students Safety Student Math Word Walls

Hsbc Bank Credit Cards Instant Approval Hsbc Banks Logo Advertising Slogans

Nearly 20 Million Will Benefit If Congress Makes The Eitc Enhancement Permanent Itep

The Diploma In Accounting Is A 2 1 2 Year Programme That Provides Students With Knowledge And Skills In Financial Acc Accounting Financial Accounting Economics